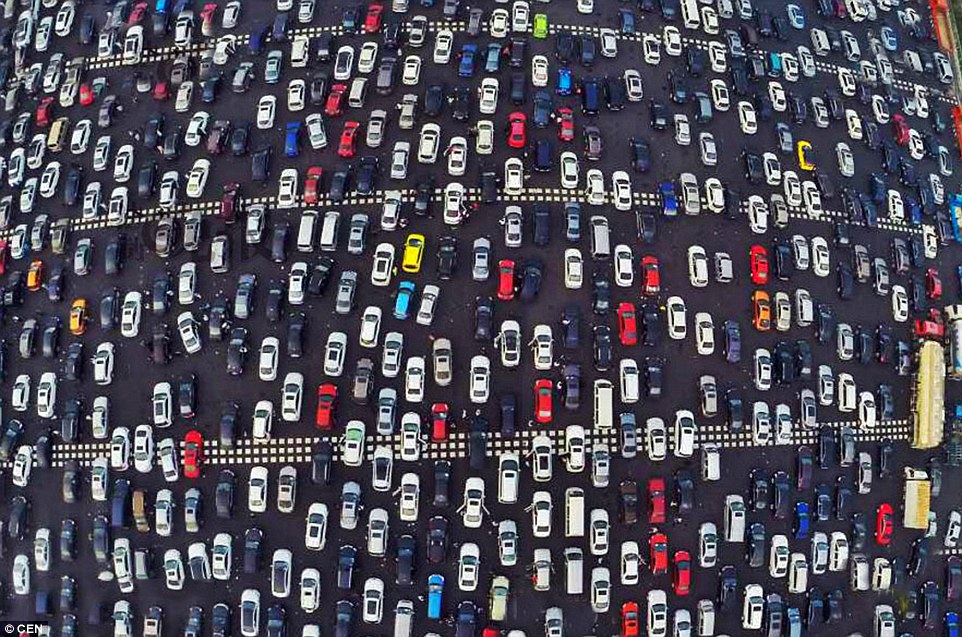

Lingering reports of an impending China bitcoin ban caused the cryptocurrency markets to contract over the weekend, but Monday brought a slight recovery. The bitcoin price saw a 3% increase, while the ethereum price experienced a 5% bump. Altogether, the recovery restored $6 billion to the total crypto market cap.

On Sunday, the Wall Street Journal–along with several other mainstream media outlets–cited unnamed sources who claimed that the People’s Bank of China (PBoC) is drafting regulations that will prohibit bitcoin exchanges from operating within the country. The sources said China will not attempt to ban over-the-counter trading or other P2P bitcoin use. Though yet to receive official confirmation, these reports added to those produced Friday by regional Chinese news sources.

The markets responded quite predictably, forcing the total value of all cryptocurrencies below $140 billion. Monday, however, the total crypto market cap reversed this trajectory, rising as high as $158 billion before tapering to a present mark of $144.5 billion.

Bitcoin Price Recovers from Sub-$4,000 Dip

Weighed down by BTC/CNY pairs on the major Chinese exchanges, the bitcoin price fell below $4,000 on Sunday. Monday’s early-morning rally raised the bitcoin price back to $4,262, but it has not yet been able to find sustained support for the $4,200 level. At the time of writing, BTC/CNY was still trading below $4,000 on OKCoin, BTCC, and Huobi. The global bitcoin price, however, is $4,150, giving bitcoin a market cap of $68.7 billion.

The near-term future of the bitcoin price will depend heavily on whether the China bitcoin ban rumors receive official confirmation, so investors should continue to expect volatility.

Ethereum Price Sees 5% Bump

The ethereum price outpaced bitcoin on Monday, rising 5% for the day. After falling to $275 on September 10, the ethereum price reached as high as $300 during the morning hours of September 11. At present, the ethereum price is $290, which translates into a market cap of $27.4 billion.

Nevertheless, concerns over ICO regulation continue to impact ethereum. Much of the focus has been on last week’s China ICO ban, but regulators in a myriad of nations have issued public warnings against the nascent fundraising mechanism. Consequently, the Swiss Crypto Valley Association has announced their support for “careful” ICO regulations that will protect investors without hampering innovation.

Altcoin Charts Turn Green

The altcoin markets were generally positive, with the exception of a few smaller coins that appear to be on the latter end of a pump-and-dump.

The bitcoin cash price rose 5% to $531, although it could not restore its market cap to the $9 billion level. The Ripple price rose 8% $0.218, bringing its total valuation within $500 million of bitcoin cash.

Fifth-place litecoin also saw its price jump 8%. The litecoin price has now recovered to $65, although this is still nearly $30 below the coin’s all-time high of $92.

Privacy-centric Dash and Monero each rose 5%, bringing their prices to respective values of $318 and $112. NEM, on the other hand, rose 4% to $0.256. Ninth-ranked IOTA rose 7% to $0.509, and ethereum classic concludes the top 10 with an 8% climb to $14.47.