Dr Paul Ennis is a research assistant at the Centre for Innovation, Technology & Organisation at University College Dublin, specializing in bitcoin and blockchain studies.

In this opinion piece, Ennis takes a dive into the kinds of sub-cultures bitcoin and cryptocurrencies enable, tracing their origins in libertarianism – and beyond.

Not everything is tameable – that’s a truism that might apply to bitcoin above all.

Recently, researchers from City University and Stockholm University introduced the concept of the “bandit organization,” calling it “a form of association or ‘band’ (frequently led by a charismatic individual) that occupies a space outside national and/or international credibility but inside the everyday practical and moral organization of specific audiences.”

Bitcoin, as we all intuitively seem to sense, is not quite a community in any usual sense.

For this reason, I’ve started to describe it as a land of bandits, “Bitcoin Country,” a term that denotes a semi-autonomous lawless region full of bandits, some noble, some not, and most certainly not cohesive.

Too formless to be a country, too amorphous to be a company, you can think of Bitcoin Country as a kind of digitally decentralized frontier.

The outlaws

Historian Eric Hobsbawm provided an early model of outlaws as social bandits that, although often violent, were celebrated by the local community as heroic or defiant.

In this way, the origin story of bitcoin is deliciously outlaw, essentially one of the individual who, through an amazing feat, harangues the evil king. It’s all the better if the king has devolved into vice and avarice to the point of financial ruin.

The other, slightly more contentious hero, operated on the edge of the edge, is the black market within the black market, the bayous of Bitcoin Country.

“The fascists always use the narrative of ‘We are the white knights in shining armor protecting against the threats. We come here and we move out the dark with pure whiteness.’ That’s a false narrative because there is corruption in those castles. The real base of power lies with us. We are the darkness.”

In the above quote, anarchist bitcoin developer Amir Taaki sets out, in the context of a documentary about the original darknet marketplace, Silk Road, a common theme within digital libertarian culture: the establishment, broadly construed, is corrupt.

Not just corrupt, its corruptness is clouded in “whiteness,” traditional forms of organizational legitimacy, and it uses narratives of fear to ensure we place our trust in them.

We need police to stop crime, we need armies to stop invaders and intelligence services to stop terrorists. Taaki’s rhetoric is hyperbolic, but it contains, implicitly, two important insights. The first is that the organizational legitimacy of central authorities is connected to our placing our trust in them in exchange for protection from threats (Taaki calls this “babysitting” a little later in the speech).

The second, a cypherpunk view, is that a powerful response to this situation, in the context of the digital world, is the creation of technological systems that subvert this power relation, “the real base of power lies with us.”

Radical dimension

These systems Taaki discusses would strive to be trustless, having no central authority and, strikingly, they would not require legitimacy. It is crucial to remember that digital libertarians do not propose a counter-legitimacy belonging to them.

They do not claim to be the truly legitimate position. Rather they revel in being “the darkness.”

Their ideal systems necessitate no “babysitters,” no trusted third party, no “legitimacy” in any traditional sense. Given such an anarchic spirit, it is no surprise that digital libertarians are drawn toward those areas deemed off-limits by authority, such as the shadow economy.

Silk Road was never just an exercise in deviant entrepreneurship, but was “presented as a means to dismantle the state.” University professor David Golumbia notes that in the wider bitcoin discourse “the idea that government itself is inherently evil” appears with “particular force.”

It was a form of activism involving a political “prefiguration” that sustained the community.

Prefiguration is a concept found in the left anarchist and autonomist Marxist traditions and developed in relation to cryptomarkets. Like most forms of political radicalism, libertarianism relies on envisioning a world that does not yet exist. Aware that this is the case, radical activists often must discover methods that justify their faith in the project.

For the anarchist and autonomist traditions, this tension has emerged quite visibly in movements such as Occupy Wall Street.

As Mathijs van de Sande explains, prefigurative politics need to be seen in terms of the ever-evolving act of bringing into being the world its adherents wish to see, but without any mainstream engagement. Crucial to prefiguration is a subtle inversion within leftist thinking.

In traditional Marxism, the relation to the state is directly antagonistic; one is against the state.

In the anarchist and autonomist view, this becomes inverted. There, to borrow from the Spanish Indignados, “We are not against the system. The system is against us.”

This redefines the nature of defiance as a focus on how best one can build new worlds despite state “interference.” It manifests as a process of instantiation of abstract ideals to come through practices occurring in the here and now.

The overriding aim is to act “as if one is already free.”

Exit over voice

The state is to be escaped rather than replaced. In other words, “exit over voice.”

According to economist Albert Hirschman, the two options open to all dissatisfied members of an organization are exit or voice. One can either exit the organization or voice dissatisfaction.

Libertarians are infamous for their preference for exit or, at least, the option of exit and, as journalist Brian Doherty charts, there have been many attempts to escape what they perceive as the ultimate closure of options, the state.

The concept of exit has even led to attempts to establish entirely new countries, known as micro-nations, their failures documented in an obscure libertarian classic “How to Start Your Country.” Arguably the most successful forms of exit have occurred by simply moving out to sea, as encapsulated in our romantic vision of anarchistic pirates, but also in the most successful micro-nation of all time, the Principality of Sealand, an offshore oil platform located not far from the coast of Suffolk, England.

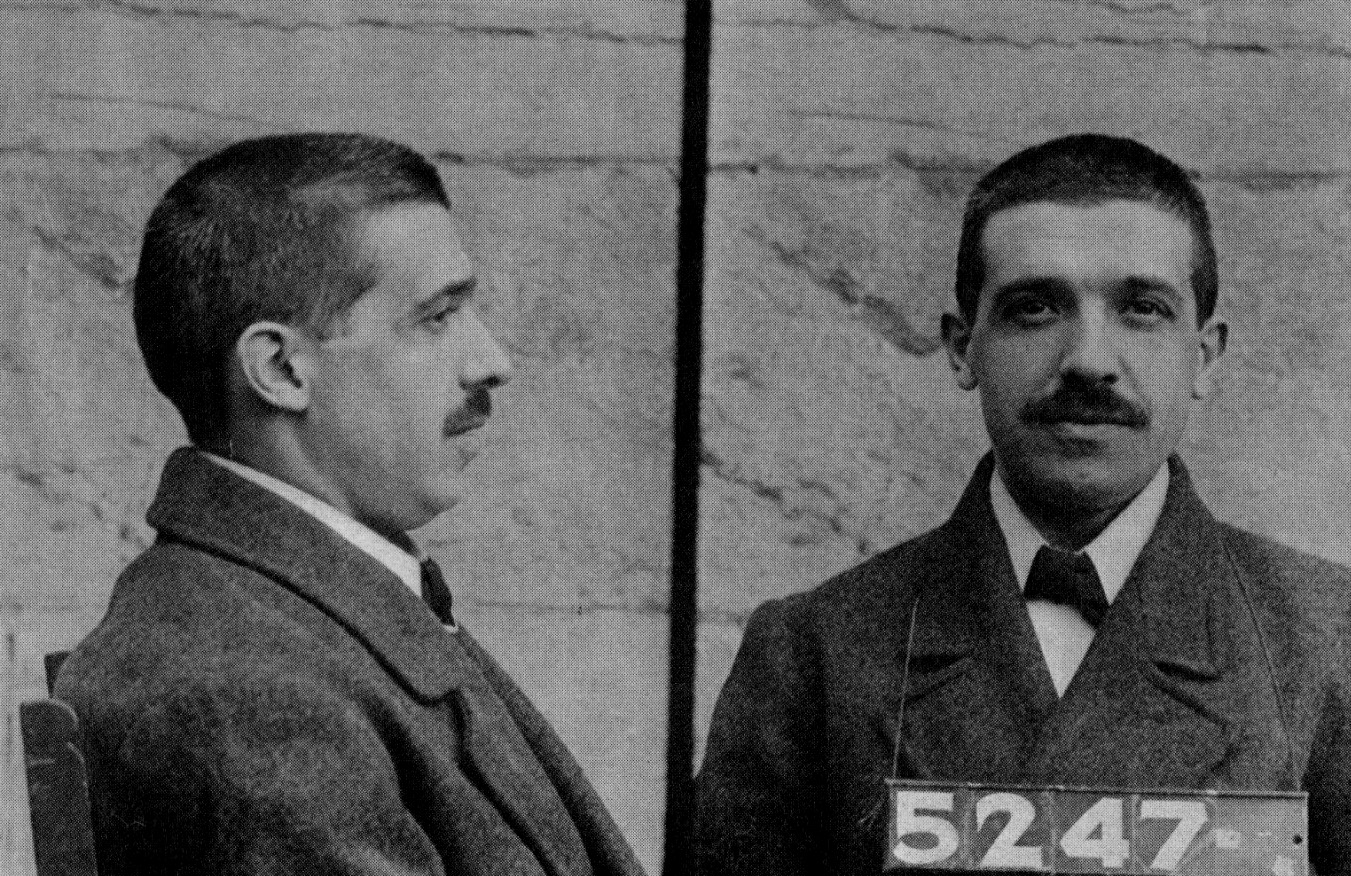

The Dread Pirate Roberts name evokes this pirate outlaw status quite explicitly (Ross Ulbrich, who ran Silk Road under that name, even notes this in discussion with Variety Jones). He had not just prefigured the world his community wanted to see, but had generated a space, a micro-nation located off the coast of the clearnet, where the law (seemingly) no longer applied.

In effect, what Ulbricht achieved was a quite unique marriage of high-minded digital libertarian ideals with the routine process of buying and selling narcotics.

For most participants, their engagement with Silk Road operationalized a sense of freedom to consume their drug of choice in the context of doing no harm to others, aligning participants with the cyber-libertarian philosophy of DPR.

Konkin’s influence

In more formal terms, organizational legitimacy on the Silk Road was ensured by reimagining the “mundane” act of buying and selling narcotics as an act of liberty.

For Ulbricht, the success of Silk Road was precisely in line with the teachings of his most important intellectual influence, Samuel Edward Konkin III. A relatively obscure figure, Konkin developed a strand of libertarianism known as agorism in the early 1970s. In his exceptionally detailed and thorough-going history of American libertarianism, Doherty references Konkin a mere five times and not once in any especially important manner.

Indeed, Konkin seems to have “fallen” out of the tradition, but this is consistent with his rejection of the Libertarian Party as inherently paradoxical, preferring instead to promote black market activism where one might “commit civil disobedience profitably.” It is not clear how Ulbricht first came across Konkin, but perhaps there was something of the kindred spirit to them, both had studied chemistry to an advanced degree.

Konkin proposed a dual course to bringing agorism into being: (1) a theoretical position known as “counter-establishment economics,” or “counter-economics” for short, and (2) the practical dimension of “counter-economic activity.” For Konkin only a small handful understand agorism, in the theoretical sense, but this does not mean that counter-economic activity does not occur.

Konkin was keen to celebrate the unconscious agorists that populate our world: tax-dodgers, black market operators, prostitutes and so on. This is where Konkin can be considered explicitly radical.

The creation of black markets was for Konkin an agorist act where small “pockets” of outlaw culture create markets more efficient than the state can provide. The more efficient these pockets the more people in the white economy will turn to agorism.

Konkin died in 2004, but he had foreseen, as early as the middle of the 1980s, that the internet opened up agorist possibilities. His remarks are worth quoting in full, given his influence upon Ulbricht:

“The internet explosion has led the American State – for now, at any rate – to throw up its tentacles at regulation of the information industry. Every legislative session, however, brings up new attempts to tax and control the World Wide Web. But consider this well: should the counter-economy lick the information problem, it would virtually eliminate the risk it incurs under the State’s threat. That is, if you can advertise your products, reach your consumers and accept payment (a form of information), all outside the detection capabilities of the State, what enforcement of control would be left?'”

This is, to be direct, quite simply what Silk Road was.

Even more prescient is that Konkin recognized the importance of encryption around the same time.

Noting that encryption meant the state “cannot reach the invoices, inventory lists, accounts and so on of the Counter-Economist,” Konkin’s proto-conception of the cryptomarket means he arrived at the idea before even the cypherpunks.