Stanley Druckenmiller, a well-known billionaire hedge fund manager, says that in an inflationary bull market, he would prefer to own bitcoin over gold “for sure.” He did say, however, that in a bear market, he would rather have gold.

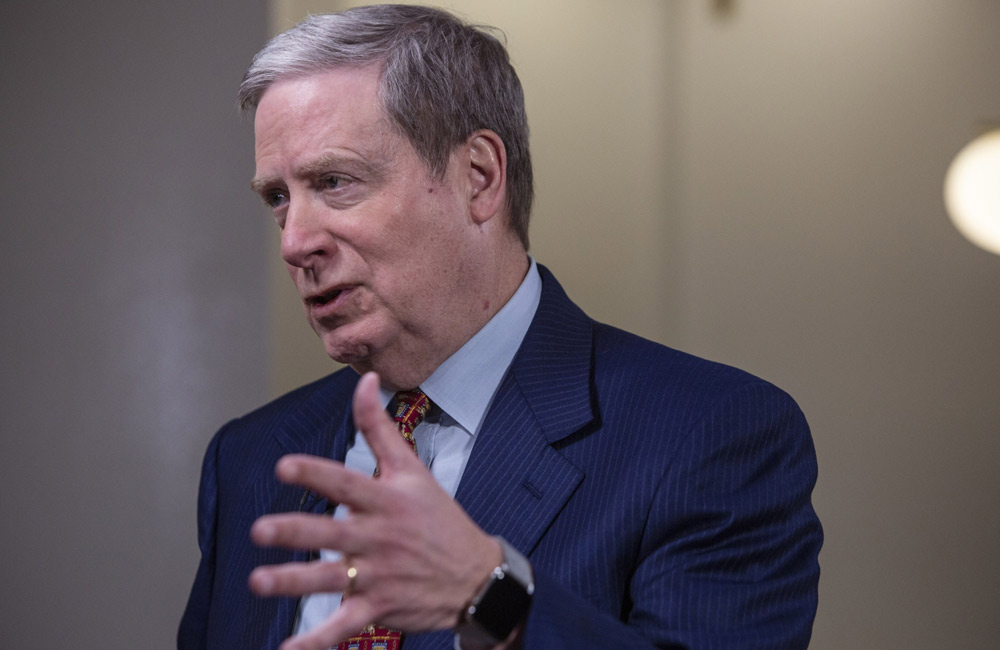

In an interview with the Sohn Conference Foundation published on Saturday, Stan Druckenmiller discussed his thoughts on bitcoin and cryptocurrency investing.

Duquesne Family Office LLC’s chairman and CEO is Druckenmiller. He previously worked at Soros Fund Management as a managing director, where he was in charge of funds with a peak asset value of $22 billion. His personal net worth is currently $6.8 billion, according to Forbes’ list of billionaires.

“If you believe we’re going to have an irresponsible monetary policy and inflation in the future,” he said, adding, “you want to own bitcoin if it’s in a bull phase.” “You want to own gold if it’s in a bear phase for other assets,” he explained.

He emphasized that he believes this to be true because he has been observing the markets long enough. “I’m starting to believe what I’m observing,” Druckenmiller stressed, adding:

For sure, if I think we are going to have an inflationary bull market, I would want to own bitcoin more than gold.

“If I thought we are going to have a bear market — you know stagflation-type things — I would want to own gold,” he clarified.

The billionaire added, “That is my assumption going forward from this point, ” noting that his assumption is 85% based on what he has observed.

Commenting on cryptocurrency investing, the famous hedge fund manager shared that according to the “high-frequency signals” he follows:

There certainly seems to be a strong correlation between crypto and the Nasdaq.

As for the future of cryptocurrency, he said: “I will be very surprised if blockchain isn’t a real force in our economy — say five years from now to 10 years from now — and not a major disruptor.” He elaborated: “Companies that will have been founded between now and then will do very well, but they will also challenge things like our financial companies and do a lot of disruption.”

Druckenmiller concluded: “So, I find crypto interesting.” However, the billionaire pointed out that his 69th birthday is coming up in a couple of weeks, noting:

I’m probably too old to compete intellectually with the young people in this space but I’m certainly monitoring it.