Pow.re Holdings Limited, a crypto mining company, claims that the company announced it had started building two new mining facilities in Asunción, Paraguay. The new data centers will control 12 MW of hydroelectric power, and the company has also purchased 3,600 Microbt Whatsminer mining rigs, which generate about 396 PH/s of hashrate each second.

Pow.re Holdings Limited Commences Mining Facility Construction in Paraguay

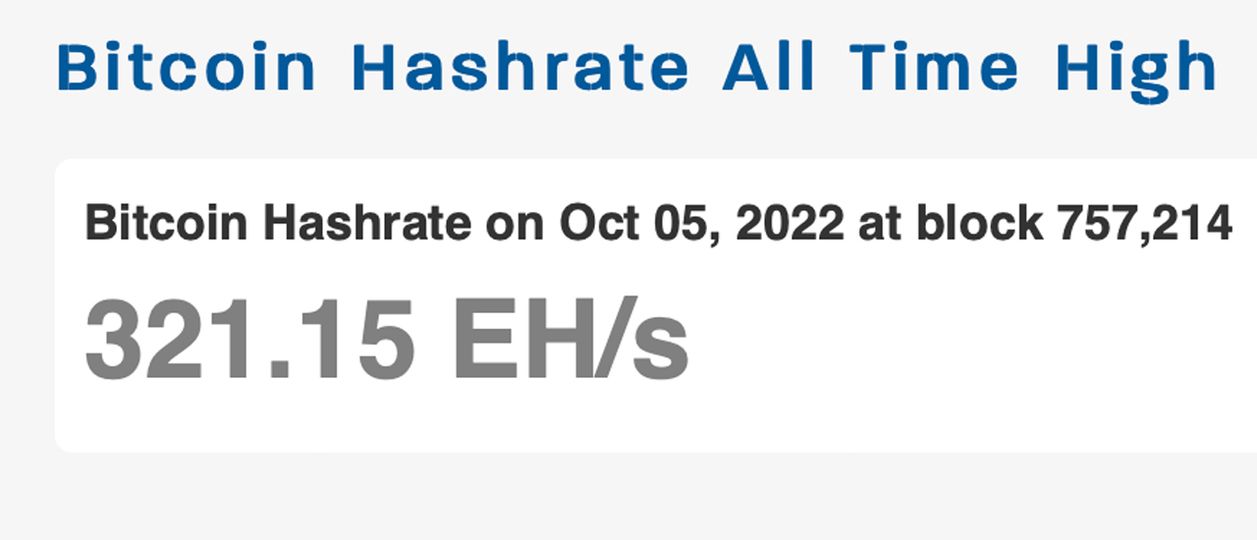

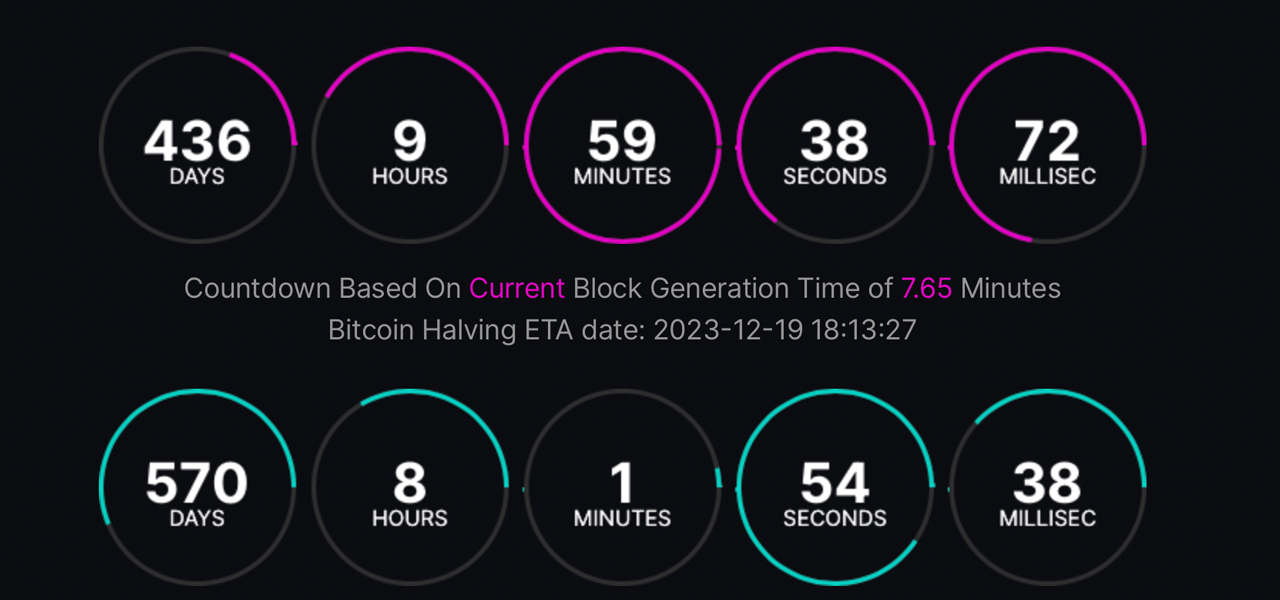

Pow.re announced on October 13 that the business has started building two new bitcoin mining facilities in Paraguay. The first site is anticipated to be ready by the end of the first quarter of 2023, and the second by the end of the fourth quarter of 2022. According to the company, the expansion will significantly increase the company’s hash power, and it aims to reach 0.5 exahashes per second (EH/s) by Q2 2023.

Pow.re recently made headlines when it was discovered that the Mohawk Council of Kahnawake in Quebec was looking to purchase power for cryptocurrency mining opportunities. The report mentioned that Pow.re was collaborating with Kahnawake council members. As far as the latest expansion in Paraguay is concerned, Pow.re’s co-founder and COO SJ Oh explained that the project stems from “two years of due diligence” coming to fruition.

“Proof-of-work protocols have the capacity to serve as synthetic batteries for stranded renewable energy sources, and we look forward to contributing to the proliferation of renewable energy generation,” Pow. re’s co-founder added during the announcement.

Firm Obtains 396 PH/s Worth of Microbt’s Whatsminer Mining Rigs

The business has also purchased 3,600 Microbt Whatsminer mining rigs in addition to beginning work on the two mining centers in the Asunción region of Paraguay. The Microbt devices are expected to be delivered to Asunción by the end of October. According to Ian Descôteaux, co-founder of the company, the machine will generate about 396 PH/s for Pow.re, and Whatsminer models are renowned for their dependability.

Descôteaux said on Thursday that “Microbt units have been the workhorse of our operations in the last two years and have proven their outstanding performance and reliability.” These new units were acquired in accordance with our counter-cyclical asset acquisition strategy, which keeps our acquisition costs below market averages and should allow us to offer our investors an industry-leading ROIC.