According to the most recent data from the United Nations Conference on Trade and Development (UNCTAD), Kenya has the highest percentage of people who own cryptocurrencies out of all the African nations. UNCTAD stated that it advises the imposition of taxes that discourage cryptocurrency trading in order to counter the growing use of cryptocurrencies.

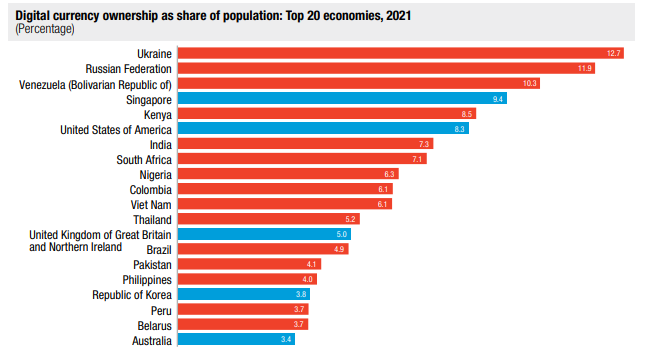

The data in the latest (UNCTAD) policy brief, Kenya’s digital currency ownership as a share of the population of 8.5% is the highest in Africa and the fifth-highest globally. Only Ukraine with 12.7%, Russia (11.9%), Venezuela (10.3%), and Singapore (9.4%) have a higher proportion of crypto-owning residents than Kenya.

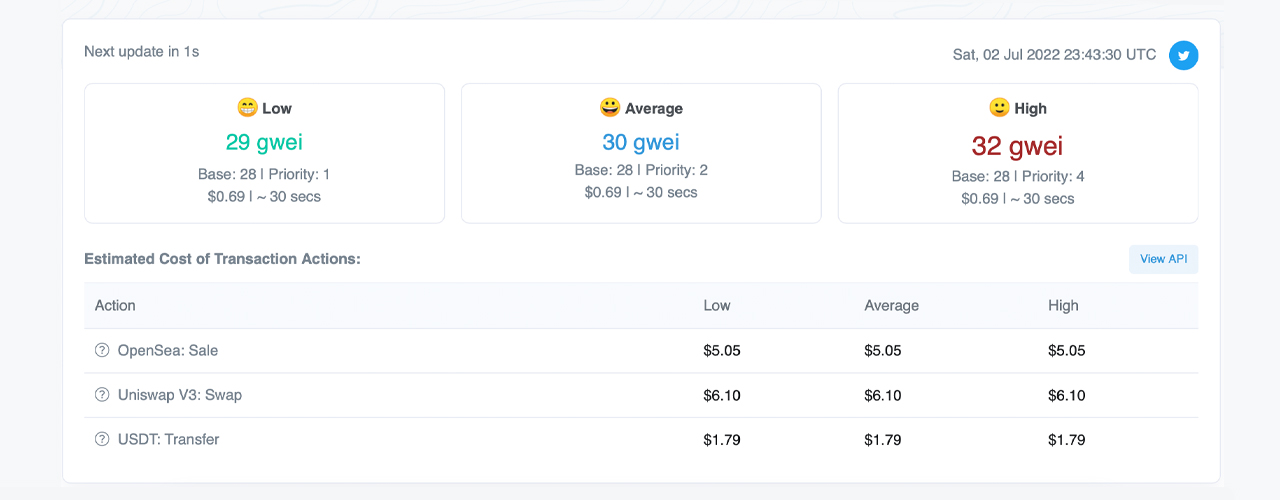

UNCTAD report June 2022.

According to the data, 7.1 percent of South Africans owned or held cryptocurrencies in 2021, placing the nation second in Africa and eighth overall. About 6.3 percent of people in Nigeria, one of the largest cryptocurrency markets in the world, own or hold cryptocurrencies. According to the UNCTAD data, this means that in 2021, out of the 211 million people who called the country home, just over 13 million were owners of digital currencies.

Australia had the lowest percentage of its population who owned cryptocurrency during the study period (3.4 percent) among the 20 nations that were examined.

Meanwhile, in a report on its findings, UNCTAD acknowledged that cryptocurrencies have grown in their popularity because they are “an attractive channel through which to send remittances.” The UN agency also said it found that middle-income individuals from inflation-hit developing countries own or hold cryptocurrencies because these are seen “as a way to protect household savings.”