According to a recent study, cryptocurrency can be a good substitute for traditional settlement procedures because it uses blockchain technology, which enables instantaneous transaction completion without the need for middlemen. Some participants in the cross-border money transfer market believe that blockchain technology and cryptocurrencies can improve remittance procedures.

In the most recent report from the International Association of Money Transfer Networks (IAMTN), it was stated that using cryptocurrencies for the settlement of transactions can be a useful “alternative to traditional settlement processes.” The report claims that this is because transactions are settled instantly on the blockchain, the technology that powers cryptocurrencies, without the need for middlemen like correspondent banks.

The importance of the blockchain for not only reducing the cost of remitting funds but also for speeding up the transfer of money across borders is further highlighted by the combination of declining correspondent banking relationships and the rising volume of cross-border transactions.

“Cross-border transactions can be settled almost instantly, thus obviating the need for pre-funding accounts in receiving countries, which is an expensive practice for remittance providers. A number of businesses, ranging from traditional remittance services providers to cryptocurrency fintechs are using blockchain technology to improve remittance processes,” explains the report.

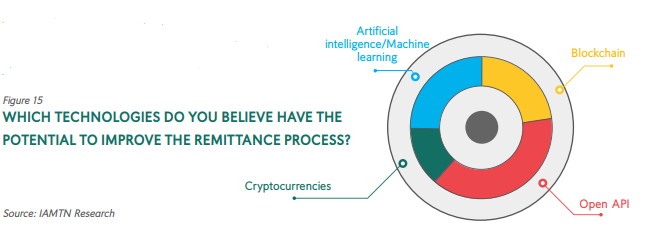

To buttress this assertion, the report includes the findings of a study by IAMTN which sought industry players’ views on innovative technologies which can improve the process of sending funds across borders. As suggested by the findings, both the blockchain and cryptocurrencies are seen as innovations that “bring [an] an infinite number of possibilities in the realm of cross-border payments.

”Open application programming interface (API) and artificial intelligence (AI) are the other two technologies perceived to have the potential to improve the remittance process, the IAMTN study also found. Besides disrupting the financial industry, many of these new technologies can “permanently improve the infrastructure behind cross-border payments, in the interest of end-users.”